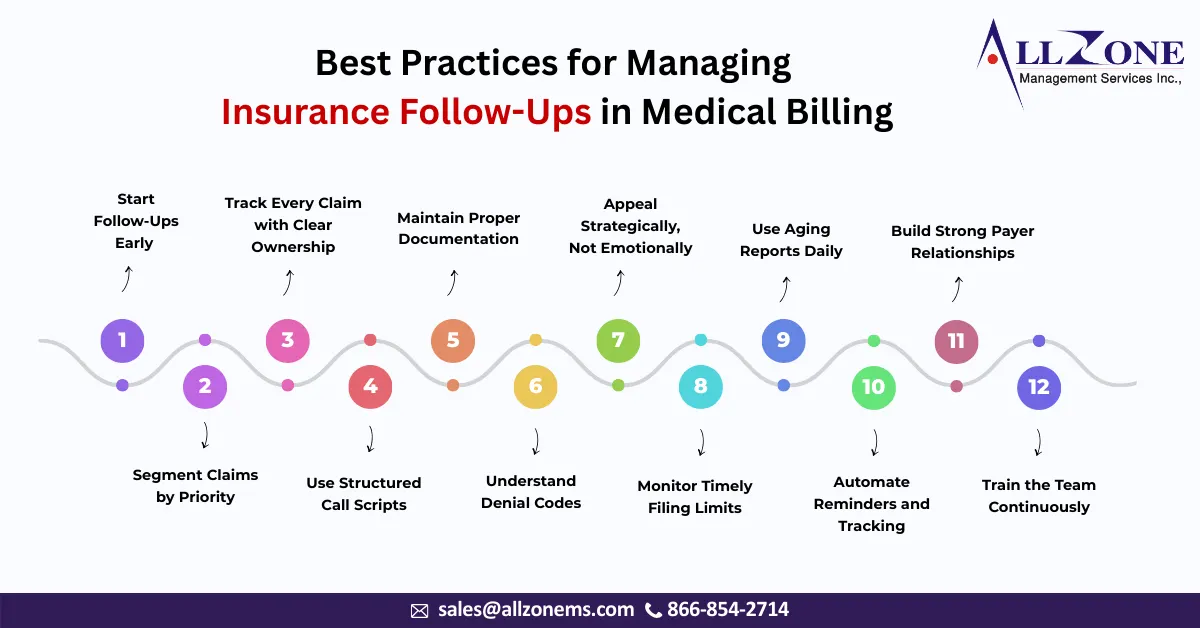

If you ask any experienced revenue cycle manager what truly determines the financial health of a healthcare organization, the answer is rarely coding or charge entry alone. The real difference often lies in one specific operational area — insurance follow-ups. Claims are submitted every day. Payments are expected every day. But revenue is actually realized […]

In the dynamic business world, cash is king. And at the heart of healthy cash flow lies effective Accounts Receivable (AR) management. Accounts Receivable represent the money owed to your business by customers for goods or services already delivered on credit. While it signifies sales and future income, if not managed diligently, it can quickly […]

Accounts Receivable (AR) days directly impact cash flow and overall financial health. The longer a claim sits in AR, the more challenging it becomes to collect revenue, leading to cash flow disruptions, operational inefficiencies, and reduced profitability. Therefore, it’s crucial for businesses to actively work to reduce AR days and improve their financial performance. With […]

Accounts receivable (AR) services are often overlooked but play a crucial role in the financial health of any business. These services involve managing the process of collecting outstanding payments from customers for goods or services sold on credit. Effective AR management can significantly impact a company’s cash flow, profitability, and overall financial stability. The Importance […]

In 30 years of running revenue management the usual suspects come up in a Key Performance Indicator (KPI) Dashboard such as Charges, Payments, Adjustments, Net Collection, Gross Collection, Days in AR, AR over 90 Days and Bad Debt. Then you have the breakouts for each category by payer, CPT Code, Location, or ICD Code. There […]

Healthcare policies and rules are continuously changing, and it’s important to stay on top of what all insurance carriers are doing and how their changes impact your practice’s revenue cycle. This, as well as managing your accounts receivable (A/R), is the best way to ensure your cash flow does not bottleneck and cause damage to […]