If you ask any experienced revenue cycle manager what truly determines the financial health of a healthcare organization, the answer is rarely coding or charge entry alone. The real difference often lies in one specific operational area — insurance follow-ups.

Claims are submitted every day. Payments are expected every day.

But revenue is actually realized only when someone consistently monitors what happens after submission.

Across hospitals, physician practices, and medical billing companies, one reality remains the same: A claim that is not followed up is a claim that is silently aging.

Denied claims, pending claims, partially paid claims, and unprocessed claims collectively create a hidden revenue gap. Many providers assume that once a claim is submitted electronically, the payer will process it. In reality, insurers handle massive claim volumes, and without structured follow-ups, many legitimate claims fall into processing delays, documentation requests, or denial queues.

Insurance follow-ups are not merely a clerical activity — they are a revenue protection strategy.

This newsletter explains, in a practical and human-focused way, how healthcare organizations can manage insurance follow-ups efficiently, reduce accounts receivable (AR) days, and improve cash flow stability.

Why Insurance Follow-Ups Matter More Than Ever

Healthcare reimbursement is no longer straightforward. Insurance policies are increasingly complex, payer rules change frequently, and claim adjudication is becoming more automated. While automation speeds payer systems, it also increases auto-denials when even minor issues are detected.

Without a strong follow-up process, healthcare providers face:

- Increasing AR days

- Rising denial rates

- Lost revenue

- Cash flow unpredictability

- Staff burnout from reactive work

Most importantly, healthcare organizations unknowingly write off revenue that was actually collectible.

Industry experience consistently shows a crucial insight:

Nearly 60–70% of denied claims are recoverable if followed up correctly and timely.

That means follow-ups are not optional — they are a core financial operation.

Understanding the Insurance Follow-Up Process

Insurance follow-up refers to the systematic monitoring of claims after submission to ensure they are processed, paid, or corrected promptly. The process begins immediately after claim submission and continues until final payment or valid resolution.

A well-structured follow-up workflow includes:

- Claim status verification

- Identifying delays or denials

- Obtaining missing documentation

- Correcting claim errors

- Filing appeals when necessary

- Posting payments and closing claims

Many organizations mistakenly start follow-ups only after 30 or 45 days. However, the most successful billing teams treat follow-ups as a scheduled cycle, not a reaction.

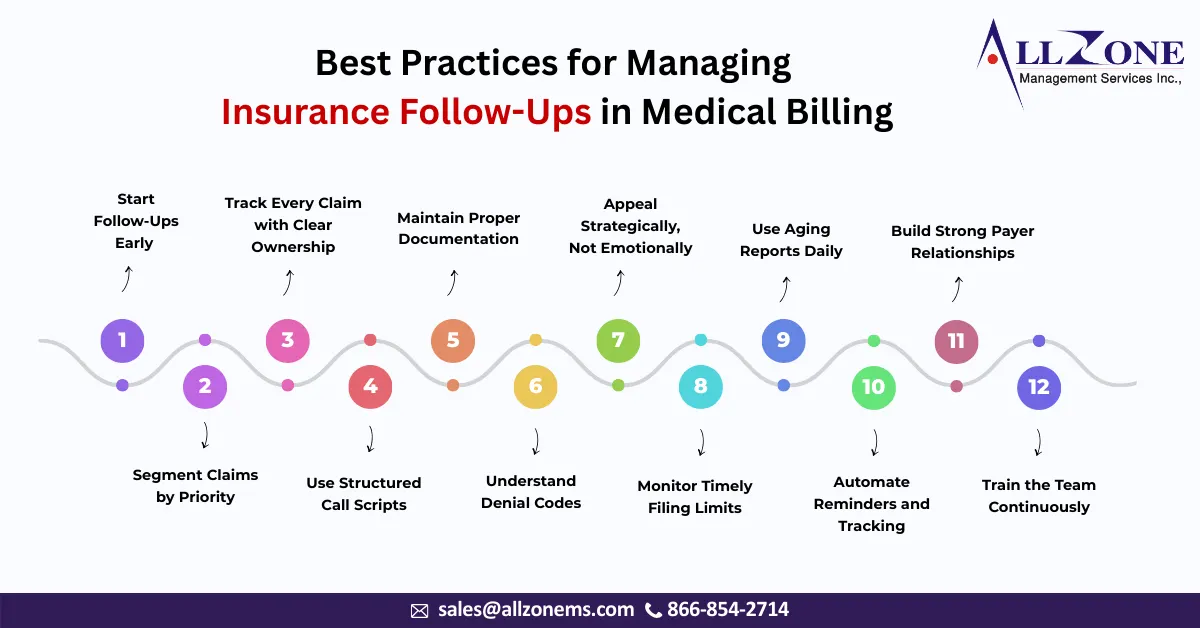

Best Practice 1: Start Follow-Ups Early (Not After Aging)

One of the most common mistakes in medical billing is waiting too long before initiating follow-ups.

Most payers have processing windows:

- 7–14 days for electronic claims acknowledgement

- 14–21 days for initial adjudication

- 30 days for payment expectation

If a claim is untouched for 30+ days, it is already at risk.

Recommended approach:

- First follow-up: 7–10 days after submission

- Second follow-up: 20 days

- Third follow-up: 30 days

- Escalation: After 35–40 days

Early intervention helps catch:

- Clearinghouse rejections

- Missing attachments

- Coordination of benefits issues

- Eligibility errors

Early follow-ups significantly reduce denial rates.

Best Practice 2: Segment Claims by Priority

Not all claims require the same attention. A smart billing team does not follow up randomly — it prioritizes.

Create claim categories such as:

High Priority

- High-value procedures

- Surgical cases

- Inpatient stays

- Out-of-network claims

- Older than 25 days

Medium Priority

- Specialty visits

- Diagnostic imaging

- Therapy services

Low Priority

- Routine office visits

- Low-dollar claims

By focusing on high-value and high-risk claims first, organizations protect major revenue sources and prevent large write-offs.

Best Practice 3: Track Every Claim with Clear Ownership

A major reason follow-ups fail is lack of accountability.

When claims are assigned to “the billing team” rather than specific staff members, responsibility becomes unclear.

Effective organizations:

- Assign AR buckets to individual billers

- Track performance by employee

- Maintain daily follow-up logs

Each claim should have:

- Last follow-up date

- Payer representative name

- Reference number

- Next action

- Next follow-up date

This prevents duplicate work and ensures continuity.

Best Practice 4: Use Structured Call Scripts

Insurance calls can be time-consuming. Without preparation, billers spend long durations navigating automated systems and inconsistent payer responses.

A structured call script improves efficiency.

Example information to confirm during a call:

- Claim received date

- Processing status

- Pending documentation

- Denial reason

- Payment release date

- Appeal eligibility

This avoids vague conversations like:

“Please check and process the claim.”

Instead, it becomes a professional financial discussion backed by documentation.

Best Practice 5: Maintain Proper Documentation

Documentation is the strongest tool in insurance follow-ups.

Every payer interaction must be documented immediately. Many appeals are won simply because the provider has accurate call records.

Document:

- Date and time

- Representative ID

- Reference number

- Instructions given

- Expected processing timeframe

If a payer later denies the claim incorrectly, this documentation becomes evidence during appeal escalation.

Best Practice 6: Understand Denial Codes

Follow-ups are ineffective if billers do not understand denial reasons.

Denial codes indicate:

- Eligibility issues

- Authorization missing

- Medical necessity problems

- Coding errors

- Timely filing limits

Instead of resubmitting blindly, trained billers analyze denial patterns.

Organizations that categorize denials monthly can identify:

- Registration errors

- Coding mistakes

- Provider credentialing gaps

- Payer-specific rules

Follow-ups then shift from reactive to preventive.

Best Practice 7: Appeal Strategically, Not Emotionally

An appeal is not simply asking the insurance company to reconsider. It is a structured argument supported by clinical and policy evidence.

A strong appeal includes:

- Corrected claim

- Medical records

- Physician notes

- Authorization proof

- Payer policy references

Appeals should be submitted within payer timelines — typically 30–60 days.

The most successful teams treat appeals like legal cases.

They present facts, documentation, and policy citations rather than general explanations.

Best Practice 8: Monitor Timely Filing Limits

Every payer has a timely filing deadline. Missing it means permanent revenue loss.

Common timelines:

- Medicare: 365 days

- Commercial payers: 90–180 days

- Medicaid: varies by state

A strong follow-up system flags claims approaching deadlines.

Many write-offs happen not due to denial — but because no one noticed the deadline approaching.

Best Practice 9: Use Aging Reports Daily

The AR aging report is the heartbeat of the follow-up process.

A disciplined team reviews:

- 0–30 days

- 31–60 days

- 61–90 days

- 90+ days

The goal is simple:

Keep the majority of revenue in the 0–30 day bucket.

Accounts older than 90 days become significantly harder to collect.

Daily monitoring prevents claims from quietly aging into write-offs.

Best Practice 10: Automate Reminders and Tracking

While follow-ups require human judgment, tracking should never be manual.

Revenue cycle systems and practice management software can:

- Trigger follow-up alerts

- Track payer response times

- Monitor denial trends

- Generate work queues

Automation does not replace billers — it guides them.

It ensures no claim is forgotten.

Best Practice 11: Build Strong Payer Relationships

Insurance companies are not just payers — they are operational partners.

Organizations that build consistent communication channels with payer representatives experience faster resolutions.

Practical steps:

- Maintain payer contact lists

- Identify provider relations representatives

- Schedule periodic review meetings

- Escalate repeat issues professionally

When payers recognize a provider as organized and persistent, claims are handled more efficiently.

Best Practice 12: Train the Team Continuously

Insurance rules change frequently. Without ongoing training, follow-ups become outdated.

Training should include:

- Policy updates

- New CPT guidelines

- Authorization rules

- Documentation requirements

- Payer portal usage

Well-trained billers resolve claims faster and reduce repeat denials.

Measuring Success: Key Follow-Up Metrics

You cannot improve what you do not measure.

Track these indicators:

- Average Days in AR

- First-pass resolution rate

- Denial rate

- Appeal success rate

- Collection percentage

- Calls per claim resolution

A strong follow-up program noticeably improves cash flow within 60–90 days.

The Human Side of Follow-Ups

Behind every unpaid claim is a real patient encounter — a consultation, surgery, therapy session, or emergency visit. Providers have already delivered care. Follow-ups ensure the organization receives rightful reimbursement for that service.

Medical billing teams often work quietly in the background, but their work sustains healthcare operations:

- Staff salaries

- Equipment purchases

- Technology upgrades

- Patient care improvements

Insurance follow-ups are not about chasing payments.

They are about protecting the ability to continue treating patients.

Medical billing success is not determined at claim submission — it is determined after submission.

Organizations that treat follow-ups casually face unpredictable revenue, mounting AR, and staff frustration. Those that implement structured follow-up processes experience:

- Faster reimbursements

- Lower denials

- Better cash flow

- Financial stability

Insurance follow-ups require persistence, organization, documentation, and strategy. When performed correctly, they transform the revenue cycle from uncertain to reliable.

In today’s healthcare environment, the difference between profit and loss often comes down to a simple operational principle:

Every claim deserves attention until it is resolves

A disciplined follow-up process ensures that no service provided goes unpaid — and that healthcare providers can continue focusing on what matters most: patient care.