The Comprehensive Error Rate Testing (CERT) program grew out of the Department of Health and Human Services Office of Inspector General improper payment rate estimates from 1996 through 2002. Due to sample size restrictions, the Centers for Medicare & Medicaid Services (CMS) assumed responsibility because they had access to more granulated data in 2003. The CERT program as we know it today was implemented to comply with the Payment Integrity Information Act of 2019. CMS implemented the CERT program to calculate the Medicare Fee-for-Service program improper payment rate. For Fiscal Year (FY) 2019, CMS estimates an improper payment rate of 3.57 percent for hospital claims paid under the Inpatient Prospective Payment System, which amounts to an estimated $4.47 billion in improper Medicare Part A payments. This is not good news for anyone, but hospitals interested in turning lemons into lemonade can use the CERT reports as guides in their risk mitigation efforts. Although the CERT program was put on hold due to the COVID-19 pandemic, it was resumed on Aug. 11, 2020.

First, a Word About CERT

The CERT program considers any claim that was paid when it should have been denied or paid at another amount to be an improper payment. If the documentation does not support that the rules were met, the claim is counted as either a total or partial payment and then categorized into one of five major categories:

- No Documentation

- Insufficient Documentation

- Medical Necessity

- Incorrect Coding

- Other

The improper payment rate is not a fraud rate, but a measure of payments made that did not meet Medicare requirements.

Top 20 Errors by Service Type (MS-DRGs)

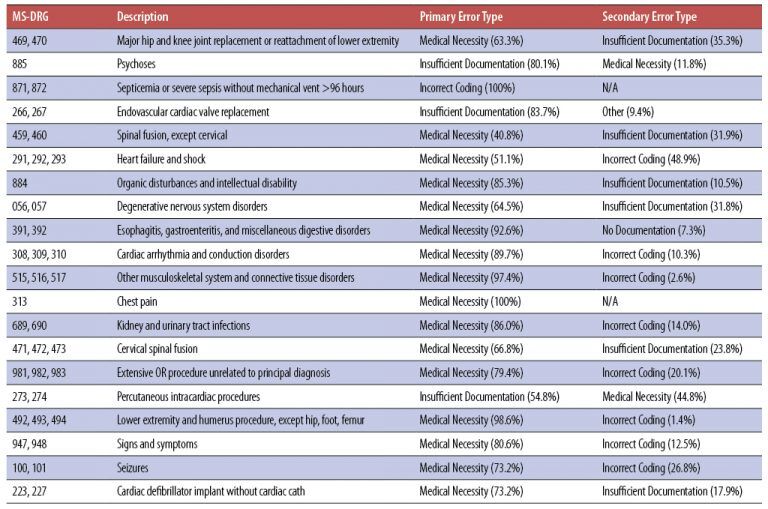

One of the tables provided by CERT identifies the top 20 error-prone Medicare Severity-Diagnosis Related Groups (MS-DRGs). Hospitals can use this information to target claims for review. A hospital may not have significant volume in all 20 DRGs, but volume levels can be used to structure monitoring in those areas with the highest risk.

The top 20 errors by service type (MS-DRGs) identified for FY 2019 are:

Watch Out for These CERT Error Types

Medical Necessity — This error occurs when there is missing or inadequate documentation to support medical necessity. Medical necessity CERT errors are typically not because the service is NOT necessary, but rather, errors are due to a failure to submit documentation or lack of documentation to support the medical necessity of the service provided. Medical necessity, for CERT purposes, is based upon Medicare coverage and payment criteria.

Typical medical necessity errors, with respect to DRGs 469 and 470, include lack of historical information, documentation of conservative treatments, and detailed information to support the surgery was reasonable/necessary. Medicare Learning Network (MLN) Matters article SE1236 speaks specifically to this area, with examples of acceptable documentation. Failure to submit documentation of previous conservative treatments and failure to meet coverage criteria are also seen for DRGs 100, 100, 223, and 227.

The most common reason for denial of spinal fusion claims (DRGs 459 and 460) has been a lack of specific information about conservative care before surgical intervention. Vague statements, such as “Failed outpatient therapy, admit for spinal fusion,” do not provide sufficient evidence of medical necessity for the admission or surgery. Documentation should include pre-procedure radiologic findings or mention of the radiology report results, failed conservative measures/treatment prior to surgery, duration of pain and/or impairment of function, physical exam indicating the functional pathology, and instability, if applicable.

In the CERT study, improper sequencing of the primary diagnosis code led to heart failure and shock (MS-DRGs 291, 292, and 293) medical necessity errors. It is the provider’s responsibility to determine whether a service is reasonable and necessary prior to submitting a claim for the service. If no coverage policy exists, auditors consider the following when determining whether an item is reasonable and necessary:

- Is it safe and effective?

- Is it experimental or investigational?

- Does it meet the following criteria?

- Appropriate duration and frequency

- Furnished in accordance with accepted standards of medical practice for the diagnosis and treatment of the patient’s condition or to improve the function of a malformed body member

- Furnished in a setting appropriate to the patient’s medical needs and condition

- Ordered and furnished by qualified personnel

- Meets, but does not exceed, the patient’s need

Errors regarding failure to provide documentation to support medical necessity for inpatient psychiatric services (DRG 884) involve medical records that have not been appropriately certified by the physician.

Medical necessity errors surrounding DRGs 056 and 057 involve failure to submit documentation that supports the submitted diagnosis and/or procedure codes.

Medical necessity errors regarding DRGs 391, 392, and 492–494 include:

- Documentation does not support the medical necessity of all services provided. Documentation should include all clinical information for the dates of service billed such as physician progress notes, histories obtained, physical examination assessments, diagnostic and laboratory test results, nurse’s notes, consultations, surgical procedures, orders, discharge summary, and any other documentation to support the inpatient admission.

- Missing documentation of services, medications, and medical interventions performed in the emergency department (ED).

To address medical necessity errors related to DRGs 308, 309, and 310, providers should be sure to include the following documentation in Additional Documentation Requests (ADRs):

- Physician’s orders for the admission and all services billed;

- Itemized list of all charges;

- Hospital admission assessment and hospital discharge summary;

- Hospital history and physical;

- Physician progress notes;

- Consultation reports;

- Plan of care;

- Diagnostic test results/reports, including imaging reports;

- Clinical therapy notes;

- All documentation to support the medical necessity of the services billed and the DRG code billed; and

- A signature log or attestation statement, if legibility of signatures is questionable.

Recovery Audit Contractors have found inappropriate selection of the principal diagnosis to be the most common issue for DRGs 308 and 309.

Medical necessity errors related to DRGs 515–517, 689, 690, and 313 were most commonly due to documentation that did not support that the services provided required an inpatient level of care and could have been performed in a less intensive setting. These are usually associated with short stays.

Spinal fusion audits (DRGs 471–473) are not new. Spinal fusion procedures require some type of device to facilitate fusion of the vertebral bones (i.e., instrumentation with bone graft or bone graft alone). When an ICD-10-PCS code includes a device value of “Z,” this means that “No Device” was used in the procedure. CMS identified ICD-10-PCS codes describing spinal fusion with a device value of “Z,” meaning they were invalid codes for spinal fusions.

Medical necessity errors for DRGs 981–983 most likely result from incorrect sequencing of the principal diagnosis, unconfirmed possible and probable diagnoses, and accuracy of the procedure code assignment.

Insufficient Documentation — These errors are based on:

- The presence of a valid provider order (or intent to order for certain services) for the service. This includes incomplete or missing signed orders or progress notes describing intent for the service to be provided.

- The presence of a valid provider plan of care for the service that meets the required elements for a plan of care.

- The presence of a submitted and fully completed required record (e.g., incomplete progress notes, unsigned, undated, insufficient detail, etc.). This includes unauthenticated medical records — no provider signature, no supervising signature, illegible signatures without a signature log or attestation to identify the signer, or an electronic signature without the electronic record protocol or policy that documents the process for electronic signatures.

- The submitted records contain inconsistent information (e.g., date, provider, service, beneficiary, etc.).

- Certification/recertification requirements have not been met.

The CERT provider documentation information website provides the following guidance with respect to inpatient acute care record requests:

“For electronic health records, send a copy of the electronic signature policy and procedures that describe how notes and orders are signed and dated. Validating electronic signatures depends on obtaining this information.”

Documentation errors related to DRG 885 revolve around the requirement that inpatient psychiatric hospitalization patients must be under the care of a physician who is knowledgeable about the patient and is responsible for certifying/recertifying the need for inpatient psychiatric hospitalization. The patient must require “active treatment” of their psychiatric disorder. The patient or legal guardian must provide written informed consent for inpatient psychiatric hospitalization in accordance with state law. If the patient is subject to involuntary or court-ordered commitment, the services must still meet the requirements for medical necessity in order to be covered by Medicare.

A common documentation error for DRGs 266 and 267 is missing evidence that two cardiac surgeons independently examined the patient face to face and evaluated the patient’s suitability for valve replacement surgery. Both surgeons must document the rationale for their clinical judgment and that the rationale was available to the heart team. National Coverage Determination (NCD) 20.32 contains all covered indications and limitations of coverage for this procedure.

An Insufficient Documentation error for DRGs 273 and 274 is related to the specificity of both the principal and secondary diagnoses. An accurate presentation of patient risks and illness severity helps hospitals receive appropriate reimbursement for the care provided.

Incorrect Coding — Claims are placed in this category when the submitted supporting documentation indicates:

- A different code than that billed;

- The service was performed by someone other than the billing provider;

- The billed service was unbundled; or

- A beneficiary was discharged to a site other than the one coded on the claim.

Common coding errors for sepsis include sequencing and differing criteria used to diagnose sepsis.

Other — Claims are placed in this category if they do not fit into any of the other categories (e.g., duplicate payment error, non-covered or unallowable service).

In these times of limited staff, armed with this information, providers can use these reports to identify risk areas to focus their compliance monitoring efforts and mitigate potential CMS audit findings.

For More Information: https://www.aapc.com/blog/52487-top-error-rates-offer-clues-to-denials/